Mark my words: this will be the year that marijuana breaks into the mainstream…

The last few years have been filled with fits and starts, but it’s high time that cannabis takes its seat as the most profitable new business sector since the tech boom.

Last year started with legalization hitting California, making it the largest North American market.

We watched as more conservative states like Utah and Oklahoma legalized medical marijuana. States like Michigan approved recreational marijuana.

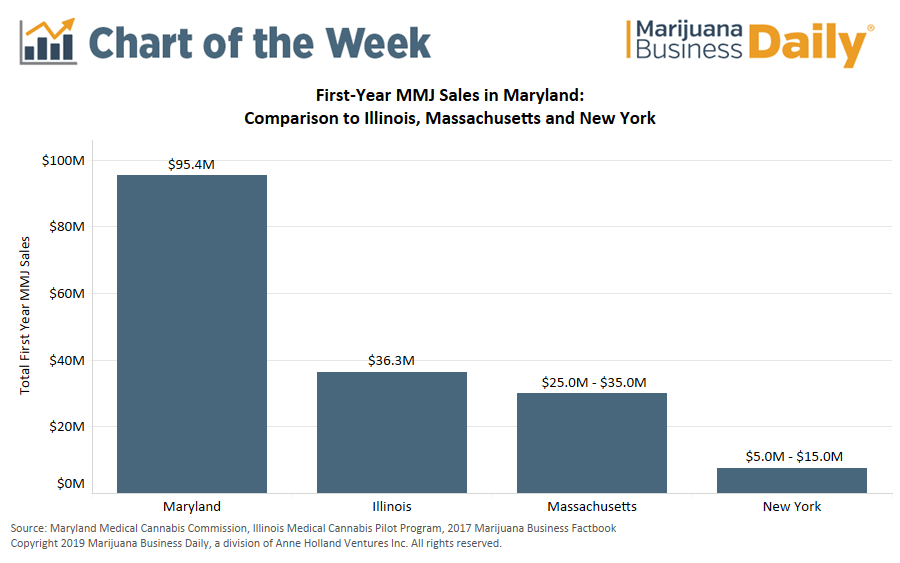

My home state of Maryland brought in almost $100 million, blowing out Illinois, Massachusetts, and New York.

I talked to dozens of patients — many of whom I never would have suspected of even considering marijuana, medical or otherwise.

Many others will follow this year…

Canada became the largest country in the world to roll out legal recreational marijuana. I was there to witness it.

Big multinational companies started throwing billions into the market. I’ve been calling that for years now.

We’ve lost money occasionally, but we’ve made incredible amounts that dwarf what was lost. I’ve been up 3,000% on some stocks, and down 80% on others. It hasn’t been an easy business to predict.

But through the slings and arrows, we’ve made a bundle and this year will mark when we can actually predict what companies are worth, and where that money is flowing into…

There are three main drivers for the marijuana market going into this year. I’ll start with the first one today…

The movement is going international, opening up massive new markets along the way. The international market for marijuana has been projected to hit $31.4 billion. That means it will more than quadruple in the next three years. It could hit $55 billion by 2025 and $140 billion by 2027.

I dare you to find growth like that in any other industry.

Australia has announced plans to become “the world’s number-one supplier” of cannabis, according to Health Minister Greg Hunt. Peak Asset Management has predicted that the Australian market will reach $1 billion by 2020 — quadrupling the current market.

Germany legalized medical marijuana last year for seriously ill patients. It will also allow health insurance to pay for it, which is a huge step forward for the industry at large. Also consider that Germany has a population over 80 million, whereas Canada has around 36 million.

The population combined with the offer of insurance payments on medical cannabis could set Germany up to be one of the world’s largest medical marijuana markets. Some analysts see it becoming the number-one market in the world for medical cannabis.

Germany is scheduled to start cultivating its own marijuana soon, which means current supply is coming from Canadian and U.S. companies like Canopy Growth Corp. (TSE: WEED) and Cronos Group (NASDAQ: CRON).

Canopy has been exporting to around 1,000 German pharmacies and has projected it will double or triple that by the end of this year.

Cronos has been in the German market since the beginning and has flourished.

Colombia legalized medical marijuana two years ago and in September it began giving out licenses to grow and export medical marijuana. Some analysts are calling it “the Saudi Arabia of legal pot.”

I am traveling to Colombia this month for some boots-on-the-ground research on one of the biggest companies, which is developing the world’s largest outdoor marijuana farm. It expects to provide low-cost exports worldwide.

Thailand just legalized medicinal use of marijuana recently. Thailand has a population of 70 million.

South Korea became the first country in eastern Asia to legalize medical cannabis. South Korea has a population of over 50 million.

The international markets will continue to open up and many of our stocks will be in position to supply them. This will also open up brand-new companies for us to gain exposure in the new year.

One major driver for the market will be takeovers…

Constellation Brands (NYSE: STZ) — the international alcohol giant that makes Corona and Svedka Vodka — finalized a $4 billion investment into Canopy Growth Corp. (TSE: WEED) (NYSE: CGC).

It has plans to develop cannabis beverages.

Tobacco giant Altria Group (NYSE: MO) — maker of Marlboro cigarettes — announced a C$2.4 billion equity investment in Cronos Group (NASDAQ: CRON).

It has plans to pivot from the declining tobacco industry into the burgeoning cannabis market.

Big companies like Coca-Cola are currently doing their research as well, and I expect other large beverage, tobacco, and pharmaceutical companies to follow suit.

In the meantime, I urge you to take a look at my latest research report.

It outlines the five companies that are poised to profit from these takeovers. Two have already been checked off. Three remain and I am confident that you’ll do well investing in their future.